Derivatives are financial instruments that derive their value from an underlying asset or benchmark. They can be used for various purposes, such as hedging against price fluctuations, speculating on future price movements, or leveraging investment positions. Derivatives can be based on a wide range of assets, including stocks, bonds, commodities, currencies, and interest rates.

There are several types of derivatives, including futures contracts, options contracts, swaps, and forwards. Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. Options contracts give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a certain time period. Swaps involve the exchange of cash flows between two parties based on predetermined terms. Forwards are similar to futures contracts but are typically customized and traded over-the-counter.

Derivatives work by allowing investors to take positions on the future price movements of an underlying asset without actually owning the asset itself. This provides investors with opportunities to profit from both rising and falling markets. For example, if an investor believes that the price of a particular stock will increase in the future, they can buy a call option on that stock. If the stock price does indeed rise, the investor can exercise the option and buy the stock at a lower price than the market value. On the other hand, if the stock price falls, the investor can simply let the option expire and limit their losses to the premium paid for the option.

Key Takeaways

- Derivatives are financial instruments that derive their value from an underlying asset or security.

- Types of derivatives include futures, options, swaps, and more, each with their own unique characteristics and uses.

- Advantages of trading derivatives include leveraging, hedging, and speculating, but they also come with risks such as volatility and counterparty risk.

- Key players in the derivatives market include banks, hedge funds, and institutional investors, and the market has a significant impact on currencies, commodities, and interest rates.

- To get started with derivatives, investors, traders, and risk managers should educate themselves on the regulatory framework, innovations, and trends in the market.

Types of Derivatives: Futures, Options, Swaps, and More

Futures contracts are one of the most common types of derivatives. They are standardized agreements to buy or sell an asset at a predetermined price and date in the future. Futures contracts are traded on exchanges and are typically used by investors to speculate on future price movements or hedge against price fluctuations. For example, a farmer may enter into a futures contract to sell their crop at a certain price in order to protect themselves against a potential decline in prices.

Options contracts give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a certain time period. There are two types of options: call options and put options. Call options give the holder the right to buy an asset at a specified price, while put options give the holder the right to sell an asset at a specified price. Options can be used for various purposes, such as hedging against price fluctuations or speculating on future price movements.

Swaps involve the exchange of cash flows between two parties based on predetermined terms. There are several types of swaps, including interest rate swaps, currency swaps, and commodity swaps. Interest rate swaps involve the exchange of fixed and floating interest rate payments, while currency swaps involve the exchange of principal and interest payments in different currencies. Commodity swaps involve the exchange of cash flows based on the price of a particular commodity.

Advantages of Trading Derivatives: Leveraging, Hedging, and Speculating

One of the main advantages of trading derivatives is the ability to leverage investment positions. Leverage allows investors to control a larger amount of assets with a smaller amount of capital. For example, if an investor wants to buy 100 shares of a stock trading at $50 per share, they would need $5,000. However, if they buy call options instead, they may only need to pay a fraction of that amount as the premium for the options. This allows investors to potentially earn higher returns on their investment.

Another advantage of trading derivatives is the ability to hedge against price fluctuations. Hedging involves taking positions that offset potential losses in other investments. For example, if an investor owns a portfolio of stocks and is concerned about a potential decline in the stock market, they can buy put options on an index that tracks the performance of the stock market. If the stock market does indeed decline, the investor can exercise the put options and offset their losses in the stock portfolio.

Derivatives also provide opportunities for speculating on future price movements. Speculation involves taking positions based on expectations of future price movements. For example, if an investor believes that the price of a particular commodity will increase in the future, they can buy futures contracts or call options on that commodity. If the price does indeed rise, the investor can profit from their positions.

Risks and Challenges of Derivatives: Volatility, Counterparty Risk, and Liquidity

| Risks and Challenges of Derivatives | Volatility | Counterparty Risk | Liquidity |

|---|---|---|---|

| Definition | The degree of variation of an asset’s price over time | The risk that the other party in a derivative contract will default | The ease with which an asset can be bought or sold in the market |

| Causes | Market conditions, economic events, political instability | Financial instability, creditworthiness of counterparties | Market depth, trading volume, bid-ask spread |

| Impact | Can lead to significant losses or gains for investors | Can result in financial losses and reputational damage | Can affect the ability to buy or sell an asset at a desired price |

| Management | Use of risk management tools such as stop-loss orders, diversification | Due diligence, credit analysis, collateralization | Monitoring market conditions, maintaining adequate reserves |

While derivatives offer various advantages, they also come with risks and challenges. One of the main risks associated with derivatives is volatility. Derivatives are highly sensitive to changes in the price of the underlying asset or benchmark. This means that even small fluctuations in the price can result in significant gains or losses for investors. For example, if an investor buys call options on a stock and the stock price declines, they may lose their entire investment.

Another risk associated with derivatives is counterparty risk. Counterparty risk refers to the risk that one party to a derivative contract will default on their obligations. This can occur if a party becomes insolvent or is unable to fulfill their contractual obligations for any other reason. Counterparty risk can be mitigated by trading derivatives on regulated exchanges or by using clearinghouses that act as intermediaries between buyers and sellers.

Liquidity is another challenge associated with trading derivatives. Liquidity refers to the ease with which a derivative can be bought or sold without causing a significant change in its price. Some derivatives, such as futures contracts and options contracts traded on exchanges, tend to be more liquid than others. Illiquid derivatives can be difficult to trade and may result in higher transaction costs or wider bid-ask spreads.

Key Players in the Derivatives Market: Banks, Hedge Funds, and Institutional Investors

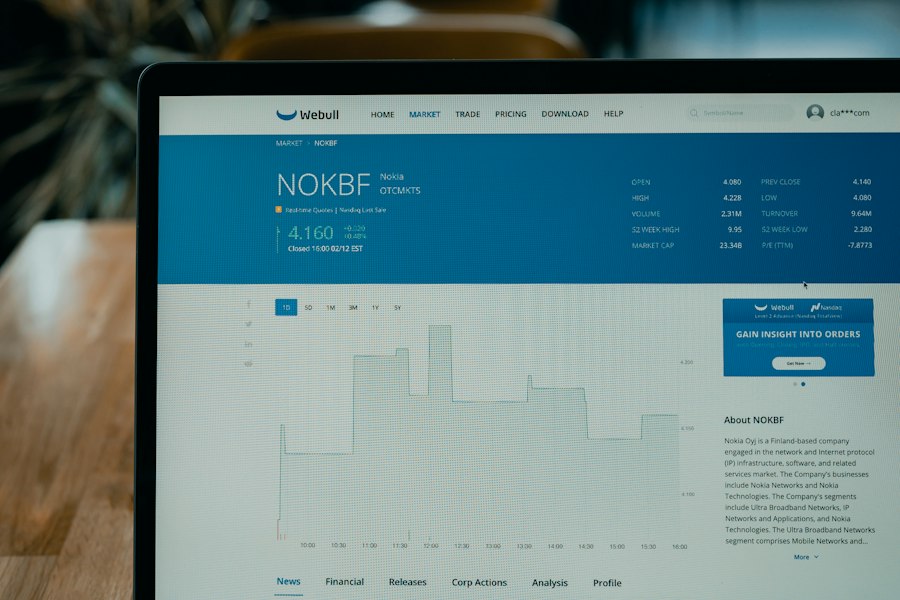

The derivatives market is made up of various types of players, including banks, hedge funds, and institutional investors. Banks are one of the largest participants in the derivatives market. They use derivatives for various purposes, such as hedging against interest rate or currency fluctuations, managing their balance sheets, or generating trading profits. Banks also act as intermediaries in the derivatives market by providing liquidity and facilitating trades between buyers and sellers.

Hedge funds are another important player in the derivatives market. Hedge funds are investment vehicles that pool capital from high-net-worth individuals and institutional investors to invest in a wide range of assets, including derivatives. Hedge funds use derivatives for various purposes, such as hedging against market risks, generating alpha (excess returns), or taking advantage of arbitrage opportunities. Hedge funds are known for their sophisticated trading strategies and ability to generate high returns.

Institutional investors, such as pension funds and insurance companies, also play a significant role in the derivatives market. These investors use derivatives to manage their investment portfolios and hedge against various risks, such as interest rate risk or currency risk. Institutional investors typically have large amounts of capital to invest and can have a significant impact on the derivatives market.

Derivatives and Global Markets: Impact on Currencies, Commodities, and Interest Rates

Derivatives have a significant impact on global financial markets, particularly in the areas of currencies, commodities, and interest rates. In the currency market, derivatives such as currency futures and options are used by investors to speculate on or hedge against changes in exchange rates. For example, if an investor believes that the value of the U.S. dollar will increase relative to the euro, they can buy call options on the U.S. dollar or sell put options on the euro.

In the commodities market, derivatives such as commodity futures and options are used by investors to speculate on or hedge against changes in commodity prices. For example, if a farmer wants to protect themselves against a potential decline in the price of corn, they can sell corn futures contracts at the current market price. If the price of corn does indeed decline, the farmer can buy back the futures contracts at a lower price and offset their losses.

In the interest rate market, derivatives such as interest rate swaps and options are used by investors to hedge against changes in interest rates. For example, if a company has borrowed money at a variable interest rate and is concerned about a potential increase in interest rates, they can enter into an interest rate swap to convert their variable-rate debt into fixed-rate debt. This allows the company to protect themselves against higher interest costs.

Derivatives and Corporate Finance: Managing Financial Risk and Enhancing Performance

Derivatives play a crucial role in corporate finance by helping companies manage financial risk and enhance performance. One of the main ways that derivatives are used in corporate finance is for hedging purposes. Companies use derivatives to hedge against various risks, such as interest rate risk, currency risk, or commodity price risk. For example, if a company has operations in multiple countries and is exposed to fluctuations in exchange rates, they can use currency derivatives to hedge against currency risk.

Derivatives can also be used to enhance performance by allowing companies to take advantage of market opportunities or optimize their capital structure. For example, companies can use derivatives to speculate on future price movements or generate trading profits. They can also use derivatives to manage their balance sheets by optimizing their debt structure or managing their interest rate exposure.

Another way that derivatives are used in corporate finance is for strategic purposes. Companies can use derivatives to gain exposure to certain assets or markets without actually owning them. For example, if a company wants to gain exposure to a particular commodity, they can enter into a commodity swap to receive the cash flows associated with that commodity. This allows the company to benefit from changes in the price of the commodity without actually owning it.

Regulatory Framework for Derivatives: Oversight, Compliance, and Transparency

The derivatives market is subject to a regulatory framework that is designed to ensure oversight, compliance, and transparency. The regulatory framework for derivatives varies by country and is typically overseen by regulatory authorities such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

One of the main objectives of the regulatory framework is to ensure that derivatives are traded on regulated exchanges or through regulated clearinghouses. This helps to mitigate counterparty risk and ensure that trades are executed in a fair and transparent manner. Regulated exchanges and clearinghouses also provide liquidity and facilitate price discovery in the derivatives market.

Another objective of the regulatory framework is to promote compliance with various rules and regulations. This includes rules related to risk management, capital requirements, reporting obligations, and disclosure requirements. Compliance with these rules helps to protect investors and maintain the integrity of the derivatives market.

Transparency is also an important aspect of the regulatory framework for derivatives. Regulators require market participants to report their positions and transactions in derivatives on a regular basis. This helps to improve market transparency and allows regulators to monitor potential risks or abuses in the derivatives market.

Innovations and Trends in Derivatives: Blockchain, Artificial Intelligence, and ESG

The derivatives market is constantly evolving, driven by technological advancements and changing market dynamics. One of the key innovations in recent years has been the use of blockchain technology in derivatives trading. Blockchain is a decentralized ledger that allows for secure and transparent transactions without the need for intermediaries. Blockchain has the potential to streamline processes, reduce costs, and increase efficiency in derivatives trading.

Artificial intelligence (AI) is another emerging trend in derivatives trading. AI refers to the use of computer algorithms and machine learning techniques to analyze large amounts of data and make predictions or decisions. AI can be used in derivatives trading to identify patterns, generate trading signals, or automate trading strategies. AI has the potential to improve trading performance, reduce human error, and increase efficiency in derivatives trading.

Environmental, social, and governance (ESG) factors are also becoming increasingly important in the derivatives market. ESG refers to the consideration of environmental, social, and governance factors in investment decision-making. Investors are increasingly demanding ESG-related products and services, and regulators are imposing stricter requirements on companies to disclose their ESG practices. This has led to the development of ESG derivatives, such as ESG futures or options, which allow investors to incorporate ESG considerations into their investment strategies.

While these innovations have the potential to bring various benefits to the derivatives market, they also come with challenges. For example, the use of blockchain technology in derivatives trading raises concerns about data privacy, cybersecurity, and regulatory compliance. Similarly, the use of AI in derivatives trading raises concerns about algorithmic bias, market manipulation, and systemic risk. It is important for market participants and regulators to carefully consider these challenges and develop appropriate safeguards.

Getting Started with Derivatives: Tips for Investors, Traders, and Risk Managers

For investors, traders, and risk managers who are new to derivatives trading, there are several tips that can help them get started and manage risk effectively. First and foremost, it is important to understand the characteristics and risks of the specific derivative instrument that you are trading. Each type of derivative has its own unique features and risks, so it is important to do your research and educate yourself before getting started.

It is also important to have a clear investment strategy and set realistic goals. Derivatives can be highly volatile and risky, so it is important to have a plan in place and stick to it. This includes setting limits on the amount of capital that you are willing to risk, as well as the maximum amount of losses that you are willing to tolerate.

Risk management is another key aspect of successful derivatives trading. This includes diversifying your portfolio, using stop-loss orders to limit potential losses, and regularly monitoring your positions. It is also important to stay informed about market developments and be prepared to adjust your positions or strategies as needed.

Finally, it is important to choose a reputable broker or trading platform that offers competitive pricing, reliable execution, and robust risk management tools. The derivatives market can be complex and fast-paced, so it is important to have access to the right tools and resources to make informed trading decisions.

In conclusion, derivatives are financial instruments that derive their value from an underlying asset or benchmark. They can be used for various purposes, such as hedging against price fluctuations, speculating on future price movements, or leveraging investment positions. There are several types of derivatives, including futures contracts, options contracts, swaps, and forwards. While derivatives offer various advantages, they also come with risks and challenges. It is important for investors, traders, and risk managers to understand these risks and challenges and develop appropriate strategies to manage them effectively.