Many factors or indicators can affect or be used to measure the economies of the world. This article explains these factors/indicators and explains how they effect the global economies.

Difference and accuracy of OER and PPP

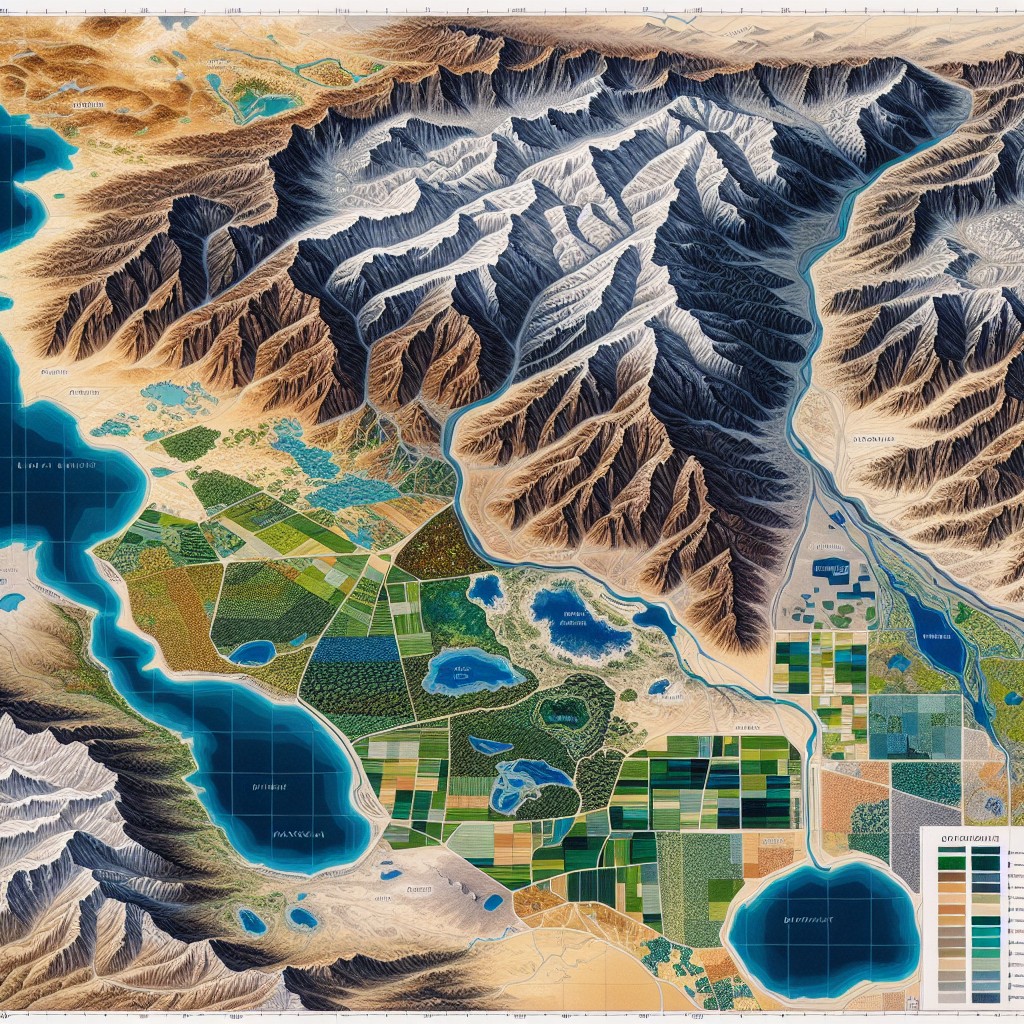

Interactive Map of Global Economies

Current account balance (BoP, current US$)

The International Monetary Fund (IMF)

Interactive Map of National Debt

Central Government Debt, Total (% of GDP)

External Debt Stocks, Total (DOD, current US$)

The Creation of Money

Thousands of years ago various goods and services would have been bartered or swapped for other such items as required. A fisherman who had a good day may have far too many fish which without the storage facilities the fish would be wasted, however these excess goods were traded for other goods or services that were required.

As far back as 12,000 BC the Earliest civilisation in Anatolia (modern day Asian part of Turkey) used to barter with obsidian or cows for goods and services. These items were very useful in their time (the stone obsidian was turned into tools or weapons) which is why they were largely accepted in payment.

It is believed that cowrie shells had been used in China as currency from around 2,500 BC but by around 1,200 BC various Kingdoms within China had created coins which had set values and created for the sole purpose of trade. This could be argued as the first form of money as we know it today. The original coins were not round and came in many shapes including spades and swords. The first form of round money was created in 210 BC by the first emperor of China, Qin Shi Huang.

Gross Domestic Product

One of the most commonly used factors or indicators as to how well global economies are doing is a nations Gross domestic Product or GDP.

The Gross domestic Product or GDP of a country is the value of all its goods and services produced in a given year. The value of a nation’s GDP is the value of its economy and indication of its wealth. To allow for accurate comparison of various countries GDP the value is converted into a single currency – usually US$.

GDP (Official Exchange Rate)

The given GDP of a country is normally based on the value of goods and services as valued in that country. It is considered the most accurate way of judging a countries economic power and is used to calculate the official exchange rate of the country’s currency.

GDP (Purchasing Power Parity)

An alternative way of calculating the GDP of several nations is to calculate the value of goods and services based on their value in a single country (usually the US). This is considered a better way of comparing the living conditions of several countries. For example a tonne of wheat or million barrels of oil are given the same monetary value using the Purchasing Power Parity (PPP) method but this would vary using the Official Exchange Rate (OER) method.

Difference and accuracy of OER and PPP

The Official Exchange Rate method is more accurate as goods and services in different countries vary somewhat and generally do have a different monetary value. A battleship, for example, produced in a less developed country is likely to be of less quality or with less technology than that produced in a more technologically advanced country and therefore have more value but using the PPP method it is likely to be considered equal.

Calculating GDP

Many factors affect countries GDP including but not limited to, trust in the market, population growth, disease, infrastructure, weather, natural disasters and war etc. This makes GDP very difficult to predict but it is can be fairly accurately calculated retrospectively using the following equation.

GDP = C + P + G + ( X – M )

C = Consumer spending on goods and service

P = Private company spending on goods and services

G= Government spending

X = Exports

M = Imports

Economic Growth

Another very useful indicator of the future of global economies is the economic growth of the nations.

Economic growth of a country is the growth of its Real Gross Domestic Product. This growth is mainly attributed to two factors.

An Increase in Aggregate Demand: which is a greater demand for the goods and services produced by a country both by its own population and by other nations (exports).

An Increase in Aggregate Supply: This is a nation’s increased capability in providing goods and services.

Calculating Aggregate Demand

Aggregate demand (AD) can be calculated using the following formula.

AD = C + I + P + G + ( X – M )

C = Consumer spending on goods and service

I = Investment by private companies

P = Private company spending on goods and services

G= Government spending

X = Exports

M = Imports

Global GDP Interactive Map

GDP growth (annual %)

Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2005 U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. Data used for global economies interactive map.

Gross savings (% of GDP)

Gross savings are calculated as gross national income less total consumption, plus net transfers. The greater the number indicates a healthy economy that is producing more than it is spending and therefore increasing national wealth. Negative numbers indicate that the economy is spending more than it creates reducing national wealth. Data used for global economies interactive map.

Current account balance (BoP, current US$)

Current account balance is the sum of net exports of goods and services, net primary income, and net secondary income. Data are in current U.S. dollars.

The current account balance is an important indicator of the health of a nation’s economy.

A Nations Current Account Balance is the difference between the amount of imports and exports of goods and services. Exporting goods brings wealth into the country while importing sends wealth out therefore a nation that has a higher amount of exports than imports is increasing its wealth.

Countries such as Germany or China that have a high current account balance are exporting more than they are importing. Countries such as the United Kingdom or United States are importing far more than they are exporting and this may be a sign of a weakening economy (although many indicators should be taken into account when assessing the strength of an economy). Data used for global economies interactive map.

Government Borrowing

Another good indicator for the future of glabal economies is to factor in a nations debt. Government borrowing can be from the public or governments of other nations and debt will obviously play a large factor in the economic growth of the global economies.

Taxation is a government’s main source of income which is used to pay for infrastructure, public services etc but quite often the cost of these public facilities cost more than they receive in tax. In these situations governments need more money and have a few options in which to generate revenue.

Raising tax is one option but is incredibly unpopular and in democratic countries this is not the preferred method.

Another option is to simply print more money, as monetary value is not based on any commodity. This however causes inflation and can lead to the callapse of the economy.

Another option is to borrow money but from whom?

The World Bank

In December 1945, shortly after its creation, the United Nations setup the World Bank which was tasked with loaning money to developing countries. Initially most of the loans were given in aid to help nations affected by WWII rebuild their economies. Once they were stabilised the World Bank turned its attention to the developing world and has so far loaned some $330 billion. The purpose of the loans is to give poorer nations the stability to grow their productivity and economy, improving the lives of its population.

The International Monetary Fund (IMF)

At the same time as setting up the World Bank the United Nations also set up the International Monetary Fund which was a separate organisation. All United Nations member states have signed up to the policies of the IMF which include allowing your currency available to be exchanged at all times and to inform the IMF about any monetary changes of policy. The nations must also be open to changes to those policies if they negatively affect other IMF members. The IMF also has a smaller pool of funds which can be lent to its members if needed but lending money is not their main role. The IMF was setup to stabalise the growth of the world’s economies and keep its members informed of any issues that may affect them so they can prepare accordingly.

Government Bonds

A government can borrow from investors offering to apply interest to the loan. They sell bonds, pieces of paper which promise a return of their initial value plus interest. As governments are funded by taxes they are pretty secure investments and very popular as it is almost a guaranteed increase on your investment.

In the United Kingdom these bonds are known as Government Liability in Sterling or GILT with two types available, conventional and index linked. The conventional is most common with each gilt valued at £100. The investor would be given 4% interest (as of 2016) and this interest is paid in instalments every 6 months (at £2 for each gilt) and finally when the gilt ‘matures’ (a date set at the time it was bought ranging from 5,10,30 or fifty years your original investment is returned.

Government bonds are available to investors from around the world and traded on stock exchanges. This is the preferred way for most governments to raise revenue in times of trouble but it does increase its debt.

Interactive Map of National Debt

Central government debt, total (% of GDP)

Debt is the entire stock of direct government fixed-term contractual obligations to others outstanding on a particular date. It includes domestic and foreign liabilities such as currency and money deposits, securities other than shares, and loans. It is the gross amount of government liabilities reduced by the amount of equity and financial derivatives held by the government. Because debt is a stock rather than a flow, it is measured as of a given date, usually the last day of the fiscal year.

External debt stocks, total (DOD, current US$)

Total external debt is debt owed to nonresidents repayable in currency, goods, or services. Total external debt is the sum of public, publicly guaranteed, and private nonguaranteed long-term debt, use of IMF credit, and short-term debt. Short-term debt includes all debt having an original maturity of one year or less and interest in arrears on long-term debt. Data are in current U.S. dollars.